Featured

Table of Contents

On the other hand, if a client requires to offer a special needs youngster that might not be able to manage their own cash, a depend on can be added as a recipient, allowing the trustee to handle the circulations. The type of beneficiary an annuity proprietor picks affects what the beneficiary can do with their acquired annuity and how the proceeds will be exhausted.

Lots of agreements allow a partner to identify what to do with the annuity after the proprietor dies. A partner can transform the annuity contract right into their name, assuming all guidelines and rights to the preliminary agreement and postponing immediate tax effects (Deferred annuities). They can gather all continuing to be settlements and any type of survivor benefit and choose recipients

When a spouse ends up being the annuitant, the spouse takes control of the stream of payments. This is called a spousal extension. This condition enables the enduring spouse to maintain a tax-deferred status and safe and secure long-lasting financial security. Joint and survivor annuities likewise permit a called beneficiary to take control of the agreement in a stream of settlements, instead of a round figure.

A non-spouse can only access the assigned funds from the annuity proprietor's first arrangement. Annuity owners can select to mark a trust as their beneficiary.

How can an Fixed Annuities help me with estate planning?

These distinctions assign which recipient will obtain the whole survivor benefit. If the annuity owner or annuitant passes away and the main beneficiary is still alive, the main recipient gets the fatality benefit. If the primary beneficiary predeceases the annuity owner or annuitant, the fatality benefit will certainly go to the contingent annuitant when the owner or annuitant dies.

The proprietor can alter recipients at any kind of time, as long as the contract does not call for an unalterable recipient to be called. According to skilled contributor, Aamir M. Chalisa, "it is essential to comprehend the relevance of marking a beneficiary, as choosing the incorrect beneficiary can have major effects. Most of our clients choose to call their minor youngsters as recipients, typically as the main recipients in the lack of a partner.

Owners that are married ought to not assume their annuity automatically passes to their spouse. When choosing a beneficiary, think about variables such as your connection with the individual, their age and just how acquiring your annuity could affect their financial circumstance.

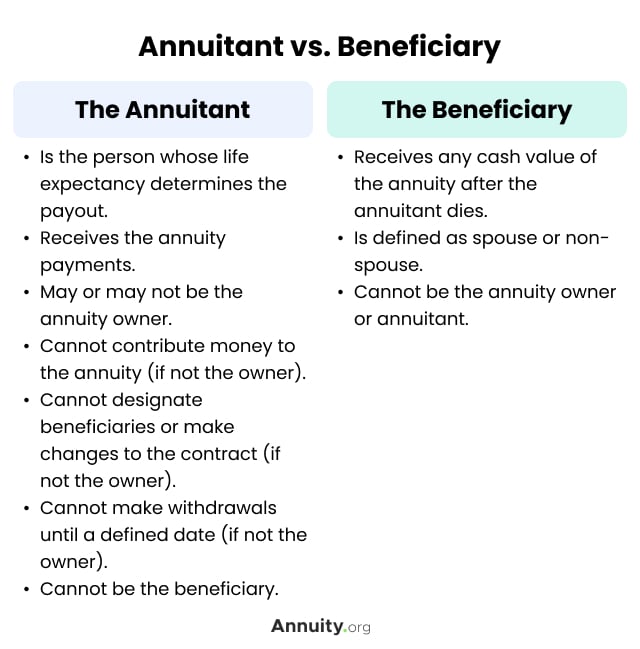

The beneficiary's connection to the annuitant typically establishes the rules they adhere to. For instance, a spousal recipient has more alternatives for taking care of an acquired annuity and is dealt with even more leniently with taxation than a non-spouse recipient, such as a youngster or other relative. Annuity contracts. Mean the proprietor does determine to call a youngster or grandchild as a beneficiary to their annuity

How does an Annuities For Retirement Planning help with retirement planning?

In estate preparation, a per stirpes designation defines that, needs to your recipient die prior to you do, the recipient's offspring (children, grandchildren, et cetera) will receive the death benefit. Get in touch with an annuity specialist. After you have actually chosen and named your recipient or beneficiaries, you have to proceed to review your choices a minimum of yearly.

Maintaining your designations up to day can make sure that your annuity will be taken care of according to your desires should you pass away suddenly. An annual review, significant life events can motivate annuity owners to take an additional appearance at their recipient selections.

Where can I buy affordable Fixed Vs Variable Annuities?

Just like any kind of monetary item, looking for the help of an economic expert can be useful. An economic coordinator can guide you with annuity monitoring processes, including the techniques for upgrading your agreement's beneficiary. If no beneficiary is named, the payment of an annuity's survivor benefit mosts likely to the estate of the annuity owner.

To make Wealthtender cost-free for visitors, we generate income from advertisers, consisting of financial specialists and companies that pay to be included. This develops a dispute of rate of interest when we prefer their promotion over others. Review our editorial plan and regards to solution for more information. Wealthtender is not a customer of these economic companies.

As an author, it is among the finest praises you can provide me. And though I really appreciate any of you spending a few of your active days reading what I compose, slapping for my post, and/or leaving praise in a remark, asking me to cover a subject for you absolutely makes my day.

It's you claiming you trust me to cover a topic that is very important for you, and that you're positive I 'd do so much better than what you can currently find on the internet. Pretty stimulating things, and a responsibility I don't take most likely. If I'm not aware of the topic, I investigate it on the internet and/or with get in touches with who understand more about it than I do.

What should I look for in an Annuities For Retirement Planning plan?

Are annuities a valid recommendation, a wise move to secure surefire earnings for life? In the easiest terms, an annuity is an insurance item (that only qualified representatives might sell) that guarantees you regular monthly payments.

Exactly how high is the surrender cost, and how much time does it use? This typically relates to variable annuities. The more riders you add, and the much less risk you agree to take, the reduced the settlements you need to expect to receive for a provided costs. Nevertheless, the insurer isn't doing this to take a loss (though, a bit like an online casino, they agree to shed on some clients, as long as they even more than make up for it in greater revenues on others).

Are Annuity Income a safe investment?

Annuities picked appropriately are the appropriate option for some individuals in some circumstances. The only method to recognize without a doubt if that includes you is to first have a comprehensive economic strategy, and after that number out if any kind of annuity option supplies sufficient benefits to validate the prices. These costs include the bucks you pay in premiums certainly, yet likewise the chance cost of not spending those funds in a different way and, for most of us, the effect on your eventual estate.

Charles Schwab has a nifty annuity calculator that shows you roughly what settlements you can anticipate from taken care of annuities. I made use of the calculator on 5/26/2022 to see what an immediate annuity could payout for a single costs of $100,000 when the insured and spouse are both 60 and stay in Maryland.

Table of Contents

Latest Posts

Decoding Pros And Cons Of Fixed Annuity And Variable Annuity A Closer Look at Fixed Index Annuity Vs Variable Annuities Defining the Right Financial Strategy Benefits of What Is Variable Annuity Vs Fi

Analyzing Strategic Retirement Planning Everything You Need to Know About Fixed Annuity Vs Equity-linked Variable Annuity What Is Annuity Fixed Vs Variable? Benefits of Choosing the Right Financial Pl

Exploring the Basics of Retirement Options A Closer Look at Fixed Annuity Vs Equity-linked Variable Annuity Defining the Right Financial Strategy Pros and Cons of Fixed Vs Variable Annuity Pros Cons W

More

Latest Posts